Building equity in real estate should be everyone’s goal.

As a real estate agent, what I have an issue with is that most people’s definition of building equity in real estate begins and ends with market appreciation, and I’ve never been a fan of this. Sure the market has gone up every year since 1994, but it did for everyone. That means if you go to sell your home, then the home you will buy will have also gone up in value. If you are cashing out that’s great, but for most of us it’s a zero sum game at best.

The point I’m trying to make here is that there’s a bigger picture that you need to look at. Real Estate is a long term play and your goal should be to position yourself regardless of how the real estate market performs. How do you do this? By paying attention to the Spread.

My definition of the Spread is finding homes and neighbourhoods that will perform better than market average in the future. To do this you need to look at a lot of factors including past performance, future trends in housing, demographics, economic factors and local government decisions- to name a few.

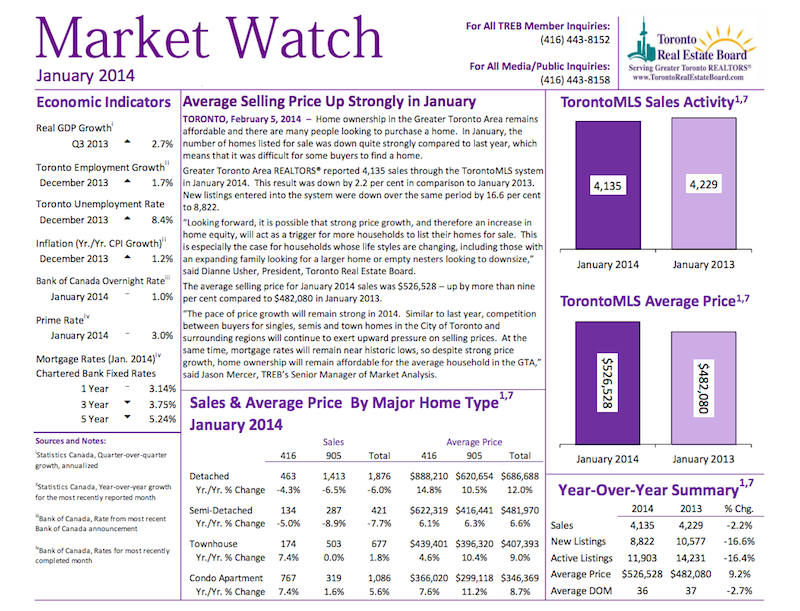

Below is a recent publication of the Toronto Real Estate Board’s Market Watch Report. Every month the report will show you all the relevant statistics, including how much the market as a whole has gone up year over year. What it doesn’t tell you is that out of the thousands of homes that sold, some neighbourhoods went up more than others, and that some housing styles were in more demand than others.

The Toronto Real Estate Market Watch Report is released monthly and is the definitive source of real estate statistics in the GTA.

By making a smart home buying decision based on the spread, you can build equity faster and when you do sell, reap the rewards. This is especially important for younger home owners who will be in the real estate market for a long time. If the market goes up you make more money and if the market goes down you’ll do better than others and you can use this leverage to move into a bigger home at a discount. You can win either way.

Looking to buy a home that will go up in value? Or are looking for a home that will build your equity the fastest? Both can be the same but they can also be different.

Are you looking to buy a home in Mississauga or the west GTA? Let’s talk!