Spring 2018 is turning out to be a Great Time for Move-up Home Buyers!

House Prices are DOWN & Condo Prices are UP!

Amid all the negative news surrounding the Toronto and Mississauga housing markets, there’s a small, and likely a very short, time limited opportunity that has been missed by most analysts. I want to share this with you today.

After studying the latest Toronto Real Estate Board Market Watch Report, I observed that the gap between condo and detached house prices is the smallest it’s been in the past 8 years. There has never been a better time since 2010 for a condo owner to jump up to a detached home. If you want to move to a detached home, and have been put off by the bidding wars and rising prices over the past 5 years, now is your time to take advantage of this blip in the market.

The chart below is comparing the average increase in prices between February 2017 to February 2018 for Mississauga.

| Housing Type | 2017 Price | 2018 Price | Percentage Change |

|---|---|---|---|

| Detached | $1,001,700 | $966,600 | -4% |

| Semi Detached | $674,900 | $651,400 | -3% |

| Town House | $510,200 | $528,200 | +4% |

| Condo Apartment | $352,600 | $406,500 | +15% |

*Information was taken from the Toronto Real Estate Board Market Watch Report ‘Focus on the MLS Home Price Index’

It’s clear from the data that condos continue to have a strong rise in sale prices, but detached home sales have softened.

We all know this anomaly in the market has been caused by government intervention policies. Buyers have been removed from the detached home market with the foreign home buyers tax, and new bank rules have put downward pressure and fear for the average buyer for how much they can afford. Once the dust settles, demand for detached homes will begin to rebuild. So for a short period of time, and no one can predict how long this will last, there is an ideal opportunity for condo owners to SELL HIGH and BUY LOW. This is the ideal scenario.

For demonstration purposes, let’s look at how much money you can potentially save in this market with current average prices. Let’s say you have a condo worth $450,000 and you want to buy a house worth $800,000. Below I will compare the scenario in 2017 versus 2018.

2017 Prices

In 2017, your condo was then worth $382,500. At the same time, the detached house you wanted would have sold for $832,000. The difference between the condo and the house was $449,500 ($832,000k-$382,500k)

2018 Prices

In 2018, your condo is now worth $450,000. At the same time, the detached house you want is selling for $800,000. The difference between the condo and the house is now $350,000 ($800k-$450k)

That’s a Savings of $99,500!

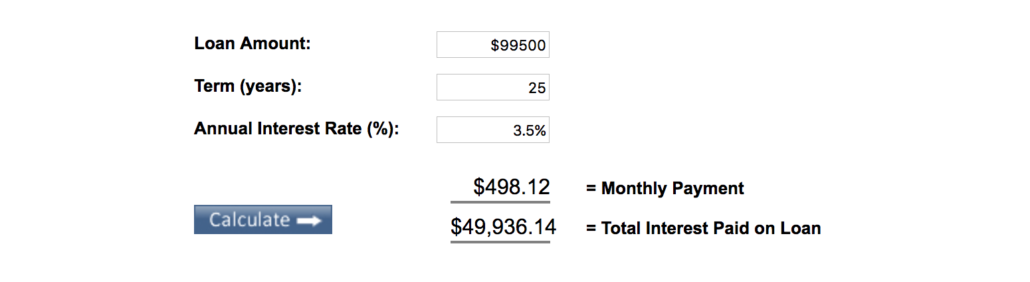

But hold on, it gets better. Let’s add in the lifetime cost of the mortgage interest that you would have paid on that $99,500 – calculated at 3.5% on a 25 year amortization. I used a loan interest calculator to find out the total interest paid. (this feature isn’t available on the banks mortgage calculator websites)

This is a simple calculation to show the approximate interest paid on a $99,500 loan at 3.5% over 25 years. Check out the calculator for yourself.

Now add $99,500 plus the additional interest savings of $49,936 you end up with a total savings of:

Total Savings

That’s a Total Saving of almost $150,000!

Should You Wait Until the Market Picks Up? What About all The Doomsday Reports of a Further Crash?

I believe the market adjustment in the detached segment has happened in large part because of the Foreign Home Buyer Tax and the tightening of pre-qualifying rules for mortgages. The government failed to address the influx of foreign money and loose lending practices – causing the spike – and then implemented measures to reduce it – causing a correction.

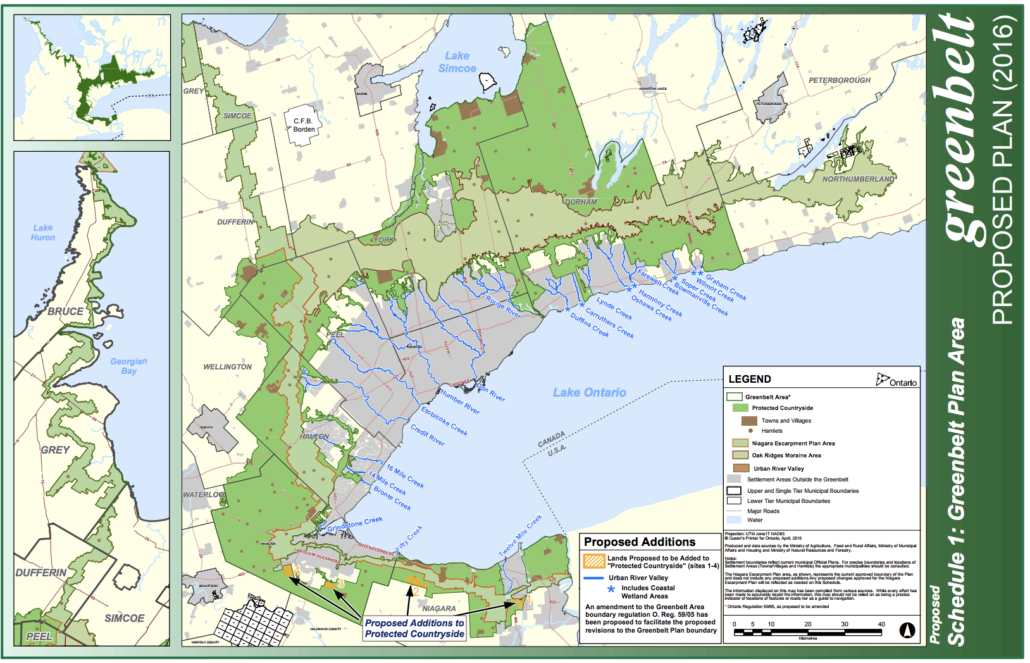

Moreover, with current government land development policies such as the Greenbelt Act, The Greater Toronto Area has become an “island” surrounded by protected land, where there is very little land left to develop. That means the supply of detached houses is forever limited, as future development will be almost all high density housing. Never again will a 60 foot wide suburban style home, a popular style in the 1970’s, be built in the GTA. So, as demand builds back and grows, it will push the prices of these detached homes back up again. Think of Manhattan Island, it’s the same concept, with strong demand to live in these areas.

The map below shows the GTA, surrounded by the GreenBelt which is protected land. The grey areas are already developed, and it’s only the tiny pockets of yellow that are left.

This map shows the designated Green belt Area in the Golden Horseshoe

When making a decision, you will never have every piece of information, none of us have a crystal ball. But if moving up to a detached home is your goal, the information we do have at the present moment would indicate that this is a good opportunity, right here, right now. The market always ebbs and flows, and there will be different opportunities and challenges in the future, but I will always calculate strategy based on what we know in the present because NO ONE knows the future.

Have any questions? Want to know more? Let’s chat!